Part C displays details of income tax directly paid by you (like advance tax, self assessment tax) and details of the challan through which you have deposited this tax in the bank.įorm 26AS will be prepared only with respect to Financial Year 05-06 onwards. Details similar to those displayed in Part A in respect of the seller and the tax collected will also be available. Part B displays details of tax collected at source (TCS) by the seller of specified goods at time these goods have been sold to you.

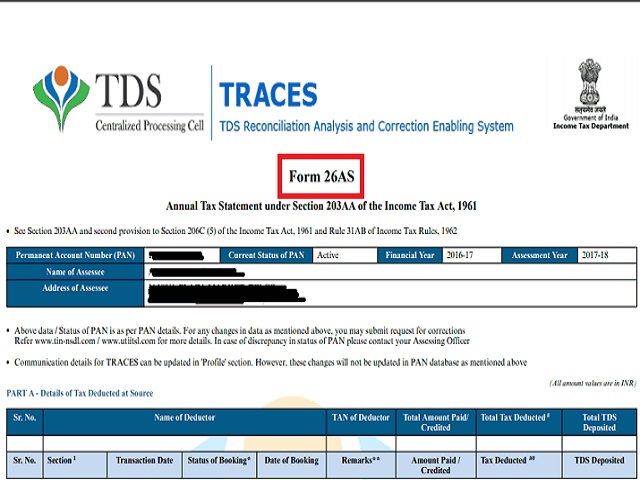

section 192 for salary), date on which payment was effected, amount paid/credited, tax deducted from payments and deposited in the bank are included in this part. Details of the deductor (name & TAN) along with details of tax deducted like section under which deduction was made (e.g. Part A displays details of tax which has been deducted at source (TDS) by each person (deductor) who made a specified kind of payment to you. The Form 26AS (Annual Tax Statement) is divided into three parts, namely Part A, B and C as under:

Manually download the Form 26AS file from the website and import the.

Users of can view tax credit in form 26AS through Bank Login : Users having PAN number registered with their Home branch can avail the facility of online view of tax credit in Form 26AS. Year enter the verification code as shown in the Captcha image click Import.

0 kommentar(er)

0 kommentar(er)